com.imsl.finance.Bond

com.imsl.finance.Bond

|

JMSLTM Numerical Library 6.1 | |||||||

| PREV CLASS NEXT CLASS | FRAMES NO FRAMES | |||||||

| SUMMARY: NESTED | FIELD | CONSTR | METHOD | DETAIL: FIELD | CONSTR | METHOD | |||||||

java.lang.Objectcom.imsl.finance.Bond

public class Bond

Collection of bond functions.

rate is an annualized rate of return based on the par value of the bills.

yield is an annualized rate based on the purchase price and reflects the actual yield to maturity.

coupons are interest payments on a bond.

redemption is the amount a bond pays at maturity.

frequency is the number of times a year that a bond makes interest payments.

basis is the method used to calculate dates. For example, sometimes computations are done assuming 360 days in a year.

issue is the day a bond is first sold.

settlement is the day a purchaser aquires a bond.

maturity is the day a bond's principal is repaid.

pricedisc(rate)priceyield(yield)pricemat(issue, rate,

yield)disc(price)yielddisc(price)accrintm, which returns the interest that has

accumulated on the discount bond.

tbillprice(rate)tbillyield(price)tbilleq(rate)price(rate, yield, redemption)yield(rate, price, redemption)received(price, rate)accrint, which returns

the interest that has accumulated at settlement from the previous coupon

date.

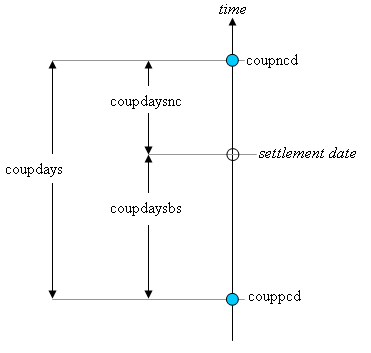

coupppcd is the coupon date immediately prior to the

settlement date.coupncd is the coupon date immediately after the

settlement date.coupdaybs is the number of days from the immediately

prior coupon date to the settlement date.

coupdaysnc is the number of days from the settlement

date to the next coupon date.

coupdays is the number of days between these two coupon

dates.

coupnum, which returns the number of coupons payable between

settlement and maturity.

Another related method is yearfrac, which returns the fraction of

the year between two days.

| Field Summary | |

|---|---|

static int |

ANNUAL

Coupon payments are made annually. |

static int |

BIMONTHLY

Coupon payments are made bimonthly (6 times per year). |

static int |

MONTHLY

Coupon payments are made monthly. |

static int |

QUARTERLY

Coupon payments are made quarterly. |

static int |

SEMIANNUAL

Coupon payments are made semiannually (twice per year). |

| Constructor Summary | |

|---|---|

Bond()

|

|

| Method Summary | |

|---|---|

static double |

accrint(GregorianCalendar issue,

GregorianCalendar firstCoupon,

GregorianCalendar settlement,

double rate,

double par,

int frequency,

DayCountBasis basis)

Returns the interest which has accrued on a security that pays interest periodically. |

static double |

accrintm(GregorianCalendar issue,

GregorianCalendar maturity,

double rate,

double par,

DayCountBasis basis)

Returns the interest which has accrued on a security that pays interest at maturity. |

static double |

amordegrc(double cost,

GregorianCalendar issue,

GregorianCalendar firstPeriod,

double salvage,

int period,

double rate,

DayCountBasis basis)

Returns the depreciation for each accounting period. |

static double |

amorlinc(double cost,

GregorianCalendar issue,

GregorianCalendar firstPeriod,

double salvage,

int period,

double rate,

DayCountBasis basis)

Returns the depreciation for each accounting period. |

static double |

convexity(GregorianCalendar settlement,

GregorianCalendar maturity,

double coupon,

double yield,

int frequency,

DayCountBasis basis)

Returns the convexity for a security. |

static int |

coupdaybs(GregorianCalendar settlement,

GregorianCalendar maturity,

int frequency,

DayCountBasis basis)

Returns the number of days starting with the beginning of the coupon period and ending with the settlement date. |

static double |

coupdays(GregorianCalendar settlement,

GregorianCalendar maturity,

int frequency,

DayCountBasis basis)

Returns the number of days in the coupon period containing the settlement date. |

static int |

coupdaysnc(GregorianCalendar settlement,

GregorianCalendar maturity,

int frequency,

DayCountBasis basis)

Returns the number of days starting with the settlement date and ending with the next coupon date. |

static GregorianCalendar |

coupncd(GregorianCalendar settlement,

GregorianCalendar maturity,

int frequency,

DayCountBasis basis)

Returns the first coupon date which follows the settlement date. |

static int |

coupnum(GregorianCalendar settlement,

GregorianCalendar maturity,

int frequency,

DayCountBasis basis)

Returns the number of coupons payable between the settlement date and the maturity date. |

static GregorianCalendar |

couppcd(GregorianCalendar settlement,

GregorianCalendar maturity,

int frequency,

DayCountBasis basis)

Returns the coupon date which immediately precedes the settlement date. |

static double |

disc(GregorianCalendar settlement,

GregorianCalendar maturity,

double price,

double redemption,

DayCountBasis basis)

Returns the implied interest rate of a discount bond. |

static double |

duration(GregorianCalendar settlement,

GregorianCalendar maturity,

double coupon,

double yield,

int frequency,

DayCountBasis basis)

Returns the Macauley's duration of a security where the security has periodic interest payments. |

static double |

intrate(GregorianCalendar settlement,

GregorianCalendar maturity,

double investment,

double redemption,

DayCountBasis basis)

Returns the interest rate of a fully invested security. |

static double |

mduration(GregorianCalendar settlement,

GregorianCalendar maturity,

double coupon,

double yield,

int frequency,

DayCountBasis basis)

Returns the modified Macauley duration for a security with an assumed par value of $100. |

static double |

price(GregorianCalendar settlement,

GregorianCalendar maturity,

double rate,

double yield,

double redemption,

int frequency,

DayCountBasis basis)

Returns the price, per $100 face value, of a security that pays periodic interest. |

static double |

pricedisc(GregorianCalendar settlement,

GregorianCalendar maturity,

double rate,

double redemption,

DayCountBasis basis)

Returns the price of a discount bond given the discount rate. |

static double |

pricemat(GregorianCalendar settlement,

GregorianCalendar maturity,

GregorianCalendar issue,

double rate,

double yield,

DayCountBasis basis)

Returns the price, per $100 face value, of a discount bond. |

static double |

priceyield(GregorianCalendar settlement,

GregorianCalendar maturity,

double yield,

double redemption,

DayCountBasis basis)

Returns the price of a discount bond given the yield. |

static double |

received(GregorianCalendar settlement,

GregorianCalendar maturity,

double investment,

double rate,

DayCountBasis basis)

Returns the amount one receives when a fully invested security reaches the maturity date. |

static double |

tbilleq(GregorianCalendar settlement,

GregorianCalendar maturity,

double rate)

Returns the bond-equivalent yield of a Treasury bill. |

static double |

tbillprice(GregorianCalendar settlement,

GregorianCalendar maturity,

double rate)

Returns the price, per $100 face value, of a Treasury bill. |

static double |

tbillyield(GregorianCalendar settlement,

GregorianCalendar maturity,

double price)

Returns the yield of a Treasury bill. |

static double |

yearfrac(GregorianCalendar start,

GregorianCalendar end,

DayCountBasis basis)

Returns the fraction of a year represented by the number of whole days between two dates. |

static double |

yield(GregorianCalendar settlement,

GregorianCalendar maturity,

double rate,

double price,

double redemption,

int frequency,

DayCountBasis basis)

Returns the yield of a security that pays periodic interest. |

static double |

yielddisc(GregorianCalendar settlement,

GregorianCalendar maturity,

double price,

double redemption,

DayCountBasis basis)

Returns the annual yield of a discount bond. |

static double |

yieldmat(GregorianCalendar settlement,

GregorianCalendar maturity,

GregorianCalendar issue,

double rate,

double price,

DayCountBasis basis)

Returns the annual yield of a security that pays interest at maturity. |

| Methods inherited from class java.lang.Object |

|---|

clone, equals, finalize, getClass, hashCode, notify, notifyAll, toString, wait, wait, wait |

| Field Detail |

|---|

public static final int ANNUAL

public static final int BIMONTHLY

public static final int MONTHLY

public static final int QUARTERLY

public static final int SEMIANNUAL

| Constructor Detail |

|---|

public Bond()

| Method Detail |

|---|

public static double accrint(GregorianCalendar issue,

GregorianCalendar firstCoupon,

GregorianCalendar settlement,

double rate,

double par,

int frequency,

DayCountBasis basis)

accrint can be found by solving the following:

![]()

issue - a GregorianCalendar issue date of the

securityfirstCoupon - a GregorianCalendar date of the

security's first interest datesettlement - a GregorianCalendar settlement date of

the securityrate - a double which specifies the security's

annual coupon ratepar - a double which specifies the security's par

valuefrequency - an int which specifies the number of

coupon payments per year; ANNUAL for

annual, SEMIANNUAL for semiannual and

QUARTERLY for quarterlybasis - a DayCountBasis object which contains the

type of day count basis to use. See DayCountBasis.

double which specifies the accrued interest

public static double accrintm(GregorianCalendar issue,

GregorianCalendar maturity,

double rate,

double par,

DayCountBasis basis)

![]()

issue - a GregorianCalendar issue date of the

securitymaturity - a GregorianCalendar date of the

security's maturityrate - a double which specifies the security's

annual coupon ratepar - a double which specifies the security's par

valuebasis - a DayCountBasis object which contains the

type of day count basis to use. see

DayCountBasis

double which specifies the accrued interest

public static double amordegrc(double cost,

GregorianCalendar issue,

GregorianCalendar firstPeriod,

double salvage,

int period,

double rate,

DayCountBasis basis)

amorlinc. However, in this method a depreciation

coefficient based on the asset life is applied during the evaluation of

the function.

cost - a double which specifies the cost of the

assetissue - a GregorianCalendar issue date of the assetfirstPeriod - a GregorianCalendar date of the end of

the first periodsalvage - a double which specifies the asset's

salvage value at the end of the life of the assetperiod - an int which specifies the periodrate - a double which specifies the rate of

depreciationbasis - a DayCountBasis object which contains the

type of day count basis to use. see

DayCountBasis.

double which specifies the depreciation

public static double amorlinc(double cost,

GregorianCalendar issue,

GregorianCalendar firstPeriod,

double salvage,

int period,

double rate,

DayCountBasis basis)

amordegrc, except that amordegrc

has a depreciation coefficient that is applied during the evaluation

that is based on the asset life.

cost - a double which specifes the cost of the

assetissue - a GregorianCalendar issue date of the assetfirstPeriod - a GregorianCalendar date of the end of

the first periodsalvage - a double which specifies the asset's

salvage value at the end of the life of the assetperiod - an int which specifies the periodrate - a double which specifies the rate of

depreciationbasis - a DayCountBasis object which contains the

type of day count basis to use. see

DayCountBasis.

double which specifies the depreciation

public static double convexity(GregorianCalendar settlement,

GregorianCalendar maturity,

double coupon,

double yield,

int frequency,

DayCountBasis basis)

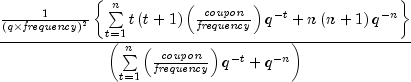

coupnum, and

settlement - a GregorianCalendar settlement date of

the securitymaturity - a GregorianCalendar maturity date of

the securitycoupon - a double which specifies the security's

annual coupon rateyield - a double which specifires the security's

annual yieldfrequency - an int which specifies the number of

coupon payments per year; ANNUAL for

annual, SEMIANNUAL for semiannual and

QUARTERLY for quarterlybasis - a DayCountBasis object which contains the

type of day count basis to use. See

DayCountBasis.

double which specifies the convexity for a

security

public static int coupdaybs(GregorianCalendar settlement,

GregorianCalendar maturity,

int frequency,

DayCountBasis basis)

settlement - a GregorianCalendar settlement date of

the securitymaturity - a GregorianCalendar maturity date of

the securityfrequency - an int which specifies the number of

coupon payments per year; ANNUAL for

annual, SEMIANNUAL for semiannual and

QUARTERLY for quarterlybasis - a DayCountBasis object which contains

the type of day count basis to use. See

DayCountBasis.

int which specifies the number of days from the

beginning of the coupon period to the settlement date

public static double coupdays(GregorianCalendar settlement,

GregorianCalendar maturity,

int frequency,

DayCountBasis basis)

settlement - a GregorianCalendar settlement date of

the securitymaturity - a GregorianCalendar maturity date of

the securityfrequency - an int which specifies the number of

coupon payments per year; ANNUAL for

annual, SEMIANNUAL for semiannual and

QUARTERLY for quarterlybasis - a DayCountBasis object which contains the

type of day count basis to use. See

DayCountBasis.

int which specifies the number of days in the

coupon period that contains the settlement date

public static int coupdaysnc(GregorianCalendar settlement,

GregorianCalendar maturity,

int frequency,

DayCountBasis basis)

settlement - a GregorianCalendar settlement date of

the securitymaturity - a GregorianCalendar maturity date of

the securityfrequency - an int which specifies the number of

coupon payments per year; ANNUAL for

annual, SEMIANNUAL for semiannual and

QUARTERLY for quarterlybasis - a DayCountBasis object which contains the

type of day count basis to use. See

DayCountBasis.

int which specifies the number of days from the

settlement date to the next coupon date

public static GregorianCalendar coupncd(GregorianCalendar settlement,

GregorianCalendar maturity,

int frequency,

DayCountBasis basis)

settlement - a GregorianCalendar settlement date of

the securitymaturity - a GregorianCalendar maturity date of

the securityfrequency - an int which specifies the number of

coupon payments per year; ANNUAL for

annual, SEMIANNUAL for semiannual and

QUARTERLY for quarterlybasis - a DayCountBasis object which contains the

type of day count basis to use. See

DayCountBasis

int which specifies the next coupon date after

the settlement date

public static int coupnum(GregorianCalendar settlement,

GregorianCalendar maturity,

int frequency,

DayCountBasis basis)

settlement - a GregorianCalendar settlement date of

the securitymaturity - a GregorianCalendar maturity date of

the securityfrequency - an int which specifies the number of

coupon payments per year; ANNUAL for

annual, SEMIANNUAL for semiannual and

QUARTERLY for quarterlybasis - a DayCountBasis object which contains the

type of day count basis to use. See

DayCountBasis.

int which specifies the number of coupons

payable between the settlement date and maturity date

public static GregorianCalendar couppcd(GregorianCalendar settlement,

GregorianCalendar maturity,

int frequency,

DayCountBasis basis)

settlement - a GregorianCalendar settlement date of

the securitymaturity - a GregorianCalendar maturity date of

the securityfrequency - an int which specifies the number of

coupon payments per year; ANNUAL for

annual, SEMIANNUAL for semiannual and

QUARTERLY for quarterlybasis - a DayCountBasis object which contains the

type of day count basis to use. See

DayCountBasis

int which specifies the previous coupon date

before the settlement date

public static double disc(GregorianCalendar settlement,

GregorianCalendar maturity,

double price,

double redemption,

DayCountBasis basis)

![]()

settlement - a GregorianCalendar settlement date of

the securitymaturity - a GregorianCalendar maturity date of

the securityprice - a double which specifies the security's

price per $100 face valueredemption - a double which specifies the security's

redemption value per $100 face valuebasis - a DayCountBasis object which contains the

type of day count basis to use. See

DayCountBasis.

double which specifies the discount rate for a

security

public static double duration(GregorianCalendar settlement,

GregorianCalendar maturity,

double coupon,

double yield,

int frequency,

DayCountBasis basis)

settlement - a GregorianCalendar settlement date of

the securitymaturity - a GregorianCalendar maturity date of

the securitycoupon - a double which specifies the security's

annual coupon rateyield - a double which specifies the security's

annual yieldfrequency - an int which specifies the number of

coupon payments per year; ANNUAL for

annual, SEMIANNUAL for semiannual and

QUARTERLY for quarterlybasis - a DayCountBasis object which contains the

type of day count basis to use. See

DayCountBasis.

double which specifies the annual duration of a

security with periodic interest payments

public static double intrate(GregorianCalendar settlement,

GregorianCalendar maturity,

double investment,

double redemption,

DayCountBasis basis)

![]()

settlement - a GregorianCalendar settlement date of

the securitymaturity - a GregorianCalendar maturity date of

the securityinvestment - a double which specifies the amount

investedredemption - a double which specifies the amount to

be received at maturitybasis - a DayCountBasis object which contains the

type of day count basis to use. See

DayCountBasis.

double which specifies the interest rate for a

fully invested security

public static double mduration(GregorianCalendar settlement,

GregorianCalendar maturity,

double coupon,

double yield,

int frequency,

DayCountBasis basis)

![]()

mduration.

settlement - a GregorianCalendar settlement date of

the securitymaturity - a GregorianCalendar maturity date of

the securitycoupon - a double which specifies the security's

annual coupon rateyield - a double which specifies the security's

annual yieldfrequency - an int which specifies the number of

coupon payments per year; ANNUAL for

annual, SEMIANNUAL for semiannual and

QUARTERLY for quarterlybasis - a DayCountBasis object which contains the

type of day count basis to use. See

DayCountBasis.

double which specifies the modified Macauley

duration for a security with an assumed par value of $100

public static double price(GregorianCalendar settlement,

GregorianCalendar maturity,

double rate,

double yield,

double redemption,

int frequency,

DayCountBasis basis)

settlement - a GregorianCalendar settlement date of

the securitymaturity - a GregorianCalendar maturity date of

the securityrate - a double which specifies the security's

annual coupon rateyield - a double which specifies the security's

annual yieldredemption - a double which specifies the security's

redemption value per $100 face valuefrequency - an int which specifies the number of

coupon payments per year; ANNUAL for

annual, SEMIANNUAL for semiannual and

QUARTERLY for quarterlybasis - a DayCountBasis object which contains the

type of day count basis to use. See

DayCountBasis.

double which specifies the price per $100 face

value of a security that pays periodic interest

public static double pricedisc(GregorianCalendar settlement,

GregorianCalendar maturity,

double rate,

double redemption,

DayCountBasis basis)

![]()

settlement - a GregorianCalendar settlement date of

the securitymaturity - a GregorianCalendar maturity date of

the securityrate - a double which specifies the security's

discount rateredemption - a double which specifies the security's

redemption value per $100 face valuebasis - a DayCountBasis object which contains the

type of day count basis to use. See

DayCountBasis.

double which specifies the price per $100 face

value of a discounted security

public static double pricemat(GregorianCalendar settlement,

GregorianCalendar maturity,

GregorianCalendar issue,

double rate,

double yield,

DayCountBasis basis)

![]()

settlement - a GregorianCalendar settlement date of

the securitymaturity - a GregorianCalendar maturity date of

the securityissue - a GregorianCalendar issue date of the

securityrate - a double which specifies the security's

interest rate at issue dateyield - a double which specifies the security's

annual yieldbasis - a DayCountBasis object which contains the

type of day count basis to use. see

DayCountBasis

double which specifies the price per $100 face

value of a security that pays interest at maturity

public static double priceyield(GregorianCalendar settlement,

GregorianCalendar maturity,

double yield,

double redemption,

DayCountBasis basis)

![]()

settlement - a GregorianCalendar settlement date of

the securitymaturity - a GregorianCalendar maturity date of

the securityyield - a double which specifies the security's

yieldredemption - a double which specifies the security's

redemption value per $100 face valuebasis - a DayCountBasis object which contains the

type of day count basis to use. See

DayCountBasis

double which specifies the price per $100 face

value of a discounted security

public static double received(GregorianCalendar settlement,

GregorianCalendar maturity,

double investment,

double rate,

DayCountBasis basis)

![]()

settlement - a GregorianCalendar settlement date of

the securitymaturity - a GregorianCalendar maturity date of

the securityinvestment - a double which specifies the amount

invested in the securityrate - a double which specifies the security's

rate at issue datebasis - a DayCountBasis object which contains the

type of day count basis to use. See

DayCountBasis.

double which specifies the amount received at

maturity for a fully invested security

public static double tbilleq(GregorianCalendar settlement,

GregorianCalendar maturity,

double rate)

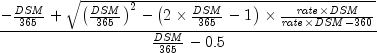

If ![]()

![]()

settlement - a GregorianCalendar settlement date of

the Treasury billmaturity - a GregorianCalendar maturity date of

the Treasury bill. The maturity cannot be more than

a year after the settlement.rate - a double which specifies the Treasury

bill's discount rate at issue date. The discount rate is

an annualized rate of return based on the par value of

the bills. The discount rate is calculated on a 360-day

basis (twelve 30-day months).

double which specifies the bond-equivalent yield

for the Treasury bill. This is an annualized rate based on the

purchase price of the bills and reflects the actual yield to

maturity.

public static double tbillprice(GregorianCalendar settlement,

GregorianCalendar maturity,

double rate)

![]()

settlement - a GregorianCalendar settlement date of

the Treasury billmaturity - a GregorianCalendar maturity date of

the Treasury bill. The maturity cannot be more than

a year after the settlementrate - a double which specifies the Treasury

bill's discount rate at issue date. The discount rate is

an annualized rate of return based on the par value of

the bills. The discount rate is calculated on a 360-day

basis (twelve 30-day months).

double which specifies the price per $100 face

value for the Treasury bill

public static double tbillyield(GregorianCalendar settlement,

GregorianCalendar maturity,

double price)

![]()

settlement - a GregorianCalendar settlement date of

the Treasury billmaturity - a GregorianCalendar maturity date of

the Treasury bill. The maturity cannot be more than

a year after the settlement.price - a double which specifies the Treasury

bill's price per $100 face value

double which specifies the yield for the Treasury

bill. This is an annualized rate based on the purchase price of

the bills and reflects the actual yield to maturity.

public static double yearfrac(GregorianCalendar start,

GregorianCalendar end,

DayCountBasis basis)

![]()

start to end,

start - a GregorianCalendar start date of the

securityend - a GregorianCalendar end date of the securitybasis - a DayCountBasis object which contains the

type of day count basis to use. See

DayCountBasis.

double which specifies the annual yield of a

security that pays interest at maturity

public static double yield(GregorianCalendar settlement,

GregorianCalendar maturity,

double rate,

double price,

double redemption,

int frequency,

DayCountBasis basis)

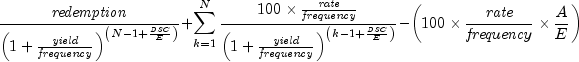

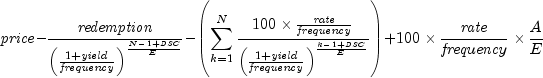

![{{{left( {{{it redemption} over {100}}

+ {{it rate} over {it frequency}}} right) - left[ {{{it price}

over {100}} + left( {{A over E} times {{it rate} over {it

frequency}}} right)} right]} over {{{it price} over {100}} +

left( {{A over E} times {{it rate} over {it frequency}}}

right)}}} times {{{{it frequency} times E} over {it

DSR}}}](eqn_0360.png)

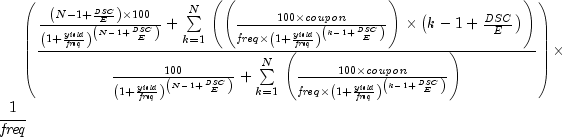

If there is more than one coupon period use the following:

settlement - a GregorianCalendar settlement date of

the securitymaturity - a GregorianCalendar maturity date of

the securityrate - a double which specifies the security's

annual coupon rateprice - a double which specifies the security's

price per $100 face valueredemption - a double which specifies the security's

redemption value per $100 face valuefrequency - an int which specifies the number of

coupon payments per year; ANNUAL for

annual, SEMIANNUAL for semiannual and

QUARTERLY for quarterlybasis - a DayCountBasis object which contains the

type of day count basis to use. See

DayCountBasis.

double which specifies the yield of a security

that pays periodic interest

public static double yielddisc(GregorianCalendar settlement,

GregorianCalendar maturity,

double price,

double redemption,

DayCountBasis basis)

![]()

settlement - a GregorianCalendar settlement date of

the securitymaturity - a GregorianCalendar maturity date of

the securityprice - a double which specifies the security's

price per $100 face valueredemption - a double which specifies the security's

redemption value per $100 face valuebasis - a DayCountBasis object which contains the

type of day count basis to use. See

DayCountBasis.

double which specifies the annual yield for a

discounted security

public static double yieldmat(GregorianCalendar settlement,

GregorianCalendar maturity,

GregorianCalendar issue,

double rate,

double price,

DayCountBasis basis)

![]()

settlement - a GregorianCalendar settlement date of

the securitymaturity - a GregorianCalendar maturity date of

the securityissue - a GregorianCalendar issue date of the

securityrate - a double which specifies the security's

interest rate at date of issueprice - a double the security's price per $100 face

valuebasis - a DayCountBasis object which contains the

type of day count basis to use. See

DayCountBasis.

double which specifies the annual yield of a

security that pays interest at maturity

|

JMSLTM Numerical Library 6.1 | |||||||

| PREV CLASS NEXT CLASS | FRAMES NO FRAMES | |||||||

| SUMMARY: NESTED | FIELD | CONSTR | METHOD | DETAIL: FIELD | CONSTR | METHOD | |||||||