| BondDuration Method |

Returns the Macauley's duration of a security where the security has

periodic interest payments.

Namespace: Imsl.Finance

Assembly: ImslCS (in ImslCS.dll) Version: 6.5.2.0

public static double Duration( DateTime settlement, DateTime maturity, double coupon, double yield, BondFrequency frequency, DayCountBasis basis )

Parameters

- settlement

- Type: SystemDateTime

The DateTime settlement date of the security. - maturity

- Type: SystemDateTime

The DateTime maturity date of the security. - coupon

- Type: SystemDouble

A double which specifies the security's annual coupon rate. - yield

- Type: SystemDouble

A double which specifies the security's annual yield. - frequency

- Type: Imsl.FinanceBondFrequency

A int which specifies the number of coupon payments per year (1 for annual, 2 for semiannual, 4 for quarterly). - basis

- Type: Imsl.FinanceDayCountBasis

A DayCountBasis object which contains the type of day count basis to use.

Return Value

Type: DoubleA double which specifies the annual duration of a security with periodic interest payments.

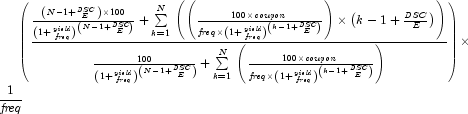

The Macauley's duration is the weighted-average time to the payments, where the weights are the present value of the payments. It is computed using the following: